Want Consistency In Your Trading? Avoid The SINGLE BIGGEST MISTAKE Most Traders Make…

The theme of this e-book is gaining consistency in your trading. That makes a lot sense of course. After all, if you’re a day trader, what could be better than adding to your account day after day?

The theme of this e-book is gaining consistency in your trading. That makes a lot sense of course. After all, if you’re a day trader, what could be better than adding to your account day after day?

And, I’m assuming, if you’re reading this, you’re pretty serious about your trading.

In fact, if I had to make a bet, I’d guess you feel about “thisclose” to being consistently successful. I’ll bet you have some good days…then give it all back in a day or two.

I’ll bet you have some setups that work nicely…until all of a sudden they don’t.

I’ll bet there are day you feel like you have it all figured out and you’re on the way to massive success…and then there are day when you feel like you’ll never have another winning trade as long as you live. Right?

Here’s the problem: There is one over-riding mistake that almost every trader makes. You’re more than likely making it too.

Here’s the problem: There is one over-riding mistake that almost every trader makes. You’re more than likely making it too.

I include myself in this. I’ve been trading since the turn of the century. For the first 7-8 years, I was very consistent…a consistent LOSER that is! I blew out more than 5 accounts in that time.

It wasn’t until my mentor taught me a new and better way of looking at the markets and a new and better way of looking at the nature of trading that I finally turned things around. And, since learning this lesson, I realized that just about every trader makes this same mistake…unless they’re lucky enough to learn the solution in time.

In this report, I will:

–> Explain this mistake

–> Explain why it causes inconsistency

–> Offer an alternative perspective

–> Tell you about my personal solution to this problem

What Is This “#1 Mistake” Most Traders Make?

Quite simply, it’s having a “setup first” mentality.

What do I mean by a “setup first” mentality? I mean that you are most likely focused first and foremost on your trade entry setup. You’re probably seeking out a set of rules that you follow to determine where and when you get into a trade.

In other words, if rule X and rule Y and rule Z are in place…you’re going to be “disciplined” and you’re going place your entry. Right?

Now, let me clarify something very important. There is NOTHING wrong with trade setups. I use several rule-based trade setups myself. I teach numerous trade setups myself. So, again, there is nothing wrong with trade setups…in fact…they’re a great tool.

Here’s the problem: IF your trade setup is the MOST IMPORTANT factor in your decision making, you’re in big trouble.

Why Doesn’t A “Setup First” Approach Work?

Very simply, different conditions REQUIRE different strategies.

Look at the image below. It’s immediately and intuitively clear that you could drive fast on a dry, flat road and stay safe. However, if you try that style on a winding, icy, mountain road, you’re probably not going to have a very happy ending.

It’s true when driving. It’s true when trading. A trade setup that works in one market condition will get killed in another market condition.

In other words, if your first focus is following the rules of your trade setup, it will work great if the market conditions HAPPEN to be in alignment with the type of trade you’re taking. However, if your trade setups HAPPENS to NOT be in alignment with the type of trade you’re taking…you’re going to get killed.

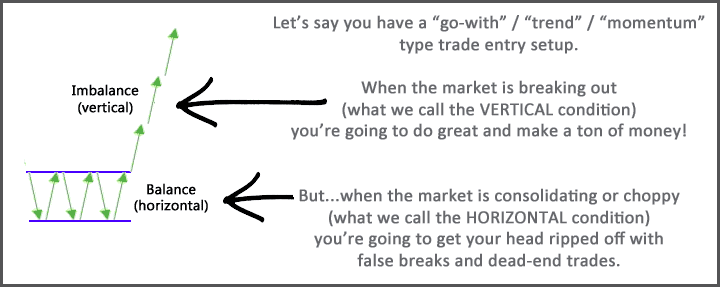

Let me put it another way. Let’s say you have a “go with” or “trend” or “momentum” or “breakout” type of trade setup. If the market is breaking out (or what I refer to as being in the VERTICAL condition), you’re going to do great and make a ton of money. However, if the market is consolidating/choppy (or what I refer to as being in the HORIZONTAL condition), your trend/momentum trade is going to get killed. You’ll have a ton of false breaks and dead-end trades.

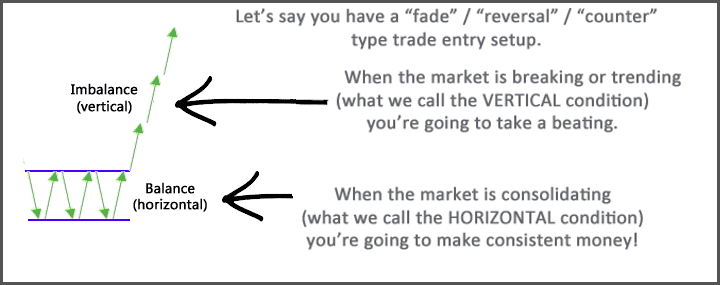

Conversely, let’s say you have more of a “fade” or “reversal” or “counter-trend” type of trade setup. When the market is consolidating (horizontal condition) you’re going to make consistent money. However, when the market starts to break from consolidation and starts to trend, your fade/reversal trade is going to take a beating.

Again…just to be crystal clear…there is nothing wrong with trade setups. Setups are great. The PROBLEM is when you do not understand the market’s condition FIRST.

In other words…

I realize the distinction between a “context-first-focus” vs. a “trade-setup-first-focus” is subtle. But, don’t underestimate it’s importance.

I consider this “shift” to be the single biggest factor in turning my trading around.

No longer was I stuck on the frustrating “hamster wheel” of:

– going on a quest for a great trade entry setup

– back testing it, sim testing it, etc.

– putting it to use in the live market…where it inevitably didn’t work as well as I’d hoped

– going back to the drawing board again and again

Nor, was I stuck in the “trap” of:

– finding a setup that actually worked!

– but, finding that it only worked “some” of the time

– knowing that if only I could eliminate my “clunkers” I’d be set…but not knowing how to do so

Once I realized that my number one job as a trader was to make sense of the market’s story FIRST…and then simply figure out which trade setup to employ based on the market context…everything turned around.

The Good News?

High probability, low-risk trade setups exist. However, if you take them blindly, whenever they appear, finding success will be difficult. The key, as explained above, is market CONTEXT first, THEN trade setup second.

The good news? Learning to read market context is a SKILL. And any skill is learn-able.

The great news? Once you learn this skill, it will pay off for the rest of your career.

What Is The Solution? How Do You Learn The Skill Of Putting The Market In Context, Day After Day?

Well, more good news…this is exactly what I focus on day after day in my trading, and it’s exactly what I teach to other like-minded traders.

First, you use a tool called “relative aggression bars” to make sense of the strength/weakness of buyers vs. sellers.

Then, you use these aggression bars as the foundation for what is called “box logic”. Boxes break the market into smaller pieces. Rather than having to make sense of everything happening, you learn to make sense of the market’s behavior within THIS current box. Plus, you learn to make sense of how each individual box relates to the others. These boxes give you an amazing STORY of what’s going on in the market each and every day.

I hear it every day from a client…by using boxes, they’re seeing the market more clearly than they ever have in their entire trading career.

Then, you take into account the bigger picture context of the market as well. What is the bigger picture bias? What are the key areas of support and resistance and are the buyers or sellers “winning” a particular level?

Finally, you put it all together and “score” a trade setup (from 1-10).

In other words, you identify a trade setup. But, rather than taking it blindly, you have the ability to make sense of the QUALITY OF THE OPPORTUNITY vs. the RISK NEEDED.

If you consistently put yourself in situations where the risk you need to take is reasonable compared to the quality of the opportunity, you very simply WILL succeed. That’s the game we’re playing. That’s how it works.

![]()

![]()

THE SPECIAL OFFER

First, thanks for reading this article! I hope you found it helpful. Additionally, I’d like to offer you more.

There are two parts to this special offer:

1) I want to give you access to a free report called “19 Traits Of Successful Traders: What Separates Winning Traders From Losing Traders“. Click here to get that report.

2) After reading that report, if you’re interested in utilizing this methodology, it tells you details about getting a special discount as well.

I hope to speak with you soon,

Justin Weinraub

DayTradeTheMarkets.com

info@daytradethemarkets.com

https://daytradethemarkets.com

ABOUT JUSTIN WEINRAUB OF DAYTRADETHEMARKETS.COM

Justin Weinraub has been trading since the year 2000. The first 7 years were a disaster. It wasn’t until he learned to put context first (before thinking about a trade setup) that things turned around.

Justin Weinraub has been trading since the year 2000. The first 7 years were a disaster. It wasn’t until he learned to put context first (before thinking about a trade setup) that things turned around.

In addition to his personal trading, Justin provides access to his proprietary “relative aggression bar’ software, teaching his “box theory” and “trade quality scoring” methodology, runs a live education room, and creates a “daily market assistant” each day.

For more information, visit https://daytradethemarkets.com.